Why Macroeconomic Structural and Wage-Price Indicators are Puzzling the Policy-Makers

Pushpa Kumari

July 30, 2019

Policy makers are puzzled. Macroeconomic variables are indicating a strong economy, but the economy’s price system is giving confusing signals. Some pieces of the puzzle, especially in the US economy, are:

- Growth has been robust, but the inflation rate is not reaching its target on a sustained basis.

- Unemployment rate is historically low, but inflation is not picking up (i.e. failing Phillips curve).

- Unemployment rate is at low levels, but rise in wage rate is not showing up.

- Why expansionary monetary policy (with unconventional methods of quantitative easing alongside ultra low policy rates) is neither able to increase inflation nor wages even when growth is robust and unemployment is low.

- Why are price indicators responding in the financial market but not in the real economy to the monetary policy expansionary stance? As the stock prices are continuously rising, and the real estate prices are also on the rise?

The US economy has been in the expansionary mode for more than a decade now and the unemployment rate is historically low being below 4 per cent for more than a year. But there is an increasing disconnect between the inflation and unemployment rates for recent couple of decades. It is almost assumed now that Phillips curve has no more relevance in the present times as it used to have 50 years ago. Also, the neutral rate of interest (i.e. neither stimulative nor restrictive rate as there is stable inflation at full employment and maximum output) has been continuously declining. One more piece of the puzzle is observed that natural rate of unemployment (i.e. noninflationary rate amid frictional, structural, and surplus unemployment) is also declining. Why are macro economic indicators not behaving as these are assumed to be? Why economy’s price system (macro price level and wage rate) is not responding to the actions of policy makers, especially the stimulative monetary policy. However, the asset prices are responding well to all the stimulations whether accommodative monetary policy rates or fiscal tax cuts.

Whether the monetary policy is failing in the rich economies or these economies are behaving weird? This is an important inquiry with an implication for the future policy framework in an era of monetarism. Especially, if recession approaches (as some observers are predicting) what will be the nature of stimulative policy discourse when neutral rate of interest is already that low. Also, how much slack will have to be removed in case of recession when the current natural unemployment rate has already been found lower than assumed previously. These are urgent questions to be answered for monetary policy to operate effectively in challenging times like ours. These answers become even more important especially when there are not many teeth left for the fiscal policy either due to fiscal deficit, public debt, falling revenues or prevailing sentiments against active government participation in the economy, or all the above.

This commentary attempts to solve the puzzles one by one and tries to answer the questions raised above with a different perspective than the official one. It highlights the need to integrate the social and economic realities in the economic data measurements. Inclusive macro indicators will not only represent structure of the economy better, but these will also have perhaps better predictability and applicability for the policy purposes.

An official version of the economic challenges and some of the answers may be summarized in following lines extracted from the speech of Mr. Jerome H. Powell, the Chair of the Board of Governors of the Federal Reserve System, on “Monetary Policy in the Post-Crisis Era” on July 16, 2019 at a conference “Bretton Woods: 75 Years Later – Thinking about the Next 75,” organized by the Banque de France and the French Ministry for the Economy and Finance, Paris, France:

“…the long-run normal levels of inflation, output, interest rates, and the unemployment rate are important structural features by which we guide policy. Standard estimates of the natural rate of unemployment—u*—and the neutral rate of interest—r*—have been declining for 2 decades, and particularly since the crisis.

Many factors are contributing to these changes—well-anchored inflation expectations in the context of improved monetary policy, demographics, globalization, slower productivity growth, greater demand for safe assets, and weaker links between unemployment and inflation. And these factors seem likely to persist. If that happens, the neutral rate of interest will remain low, and policymakers will continue to operate in an environment in which the risk of hitting the effective lower bound is much higher than before the crisis. This proximity to the lower bound poses new complications for central banks and calls for new ideas.”

However, this commentary boldly points out to another aspect related with the economic data. Current data don’t reflect the changing structural realities of the developed economies. For example, hyper-globalization, de-industrialization, inequality, jobs precariousness, gig economy, missing middle class, corporation power – especially of GAFA (Google, Apple, Facebook, Amazon), artificial intelligence, and robotization etc. have changed these economies drastically. These economies are structurally different now than some decades ago. Economic data should reflect such social and economic realities. But official data do not represent so, unfortunately. Therefore, there is a need to make economic data more inclusive and relevant in consistence with the prevailing conditions.

Inflation Rate Puzzle

Let’s take the case of inflation rate first. Inflation targeting focuses on the inflation rates based on the consumer price index constructed from the consumption basket of the representative consumers. But the concentration of wealth and income inequalities have made the official representative consumption basket non-representative for majority of the consumers. Majority of people even can’t afford now many goods and services included in the basket. Middle class which used to represent the urban consumers is almost non-existent now. As average middle-class people have gone missing, so as the relevance/representation of an average consumption basket. Population is made of either the privileged or non-privileged, popularly known as 1% versus 99%. Clearly, the average has no meaning in this context. How many Americans are able to consult a doctor, how many Canadians are able to fill their prescriptions; perhaps they can’t afford it. How many citizens are able to afford the college fee? How many of them can afford travel? Therefore, the average is hardly any representation of the majority now.

Another area that needs relook is linked with the recent disconnect of the inflation from the unemployment level, wage rate, and policy rate stance etc. Limited coverage of the total domestic economic activity by the inflation figures is at the root of such disconnect between the inflation and domestic economic indicators. Official inflation rates now represent only a limited sphere of the total domestic economic activity. First, inflation rate excludes a large chunk of economic activities from it by not including these in the consumption basket, which however impacts the economy and society profoundly. This is the financial sector inflation (ballooning assets, including real estate, prices). Second, it includes goods and services which don’t involve any domestic economic activity at all. These are the imported goods and services (most manufactured goods and tradable services are imported now) which are, of course, way cheaper than the domestic ones. These, however, represent the foreign land’s economic activities and has nothing to do with the domestic economy. How can then domestic inflation rate be assumed to react to the actual economic activity when – it excludes major inflationary part of the domestic activity (assets economy) on the one hand, and includes major deflationary part of the non-domestic (foreign) economic activity on the other.

Ask majority of the citizens how much they are benefited by the low rates of inflation. How much they are able to save for future out of their current income when things are that cheap for that long (low and stable inflation rates since the 1990s). In fact, they are able to save hardly anything after paying for ballooning rent/mortgage/bills/essential services out of their stagnant wages. Household debt figures tell loud the whole story. If the inflation rate is so low, where is income being spent then? Why are they compelled to borrow then? So, a typical disconnect between inflation and other economic variables are not only felt by highly intelligent monetary economists or policy makers, but this is also felt by the majority of common people too who never see any net benefit coming home from the low inflation!

Puzzling Response of Expansionary Monetary Policy

When policy-makers talk about increasing the economic activity with expansionary or accommodative monetary policy – what do they talk about? And which wage-price would go up without any major impact on the actual real economic activity? Most of the real economy’s activities are now out of the realm of domestic interest and wage sensitivity. Hyper-globalization and de-industrialization have made most rich economies depending on a limited number of big industries like, auto (declining as well), weapons, military vehicles/items, medical instrumentation, construction machinery, planes, and trains etc. These big industries hardly wait for changes in the policy-rates. Also, being highly technical (robots have already substituted most labor) or strategic, these are hardly sensitive to the wage changes. When interest-elastic and wage-elastic industrial sector (e.g. the semi-durable goods producing) has disappeared with the de-industrialization, and the remaining industries (large and/or highly technical/strategic) are neither interest-elastic nor wage-elastic; the policy rate changes will not have the effect, in a big way, obviously on the economic activity and wages.

Who does react to the interest rate changes? The players (mostly speculators) in the assets (Stock/commodity/real estate) markets and the foreign exchange markets who have to make their portfolio decisions to take profit from the monetary policy-stance. So, the asset markets and assets holders welcome the accommodative policy stance which increases the value of their assets at one stroke of the monetary authority.

Have common people ever heard applauding or criticizing the policy stance? Why do they feel neutral? Without job quality, job security, future security (no pension or savings), and all these alongside the debt-loads; they feel not only intergenerationally (as compared to their baby-boomer parents or grandparents) under-privileged, but they feel absolutely deprived as well. They are already too overburdened with their demanding one/two/three job/s to make their ends meet. Lowering policy rate make their life perhaps even harder by making the rentals and mortgages (for the potential buyers) higher on ever rising real estate or by making any other assets out of their reach. Lost investment opportunities led by de-industrialization and also increasing the rental/value of the commercial space have converted the potential small entrepreneurs into traders (of imported goods) at amazon or similar platforms in the gig economy. This is what a transformed economic structure is providing the small entrepreneurs the only platform to be creative and innovative; and then on the top of that they are asked to compete with the direct manufacturers of China or even amazon, the market-place owner (who knows the pricing/ sourcing/ advertising and all other business information about the traders). Going through such harsh realities, the common people have nothing to feel happy or grudge about the policy rate changes. Their struggle is not going to change anyway, as the changing structure of the economy gives no hope to them!

Neutral Interest Rate Puzzle

Let’s now concentrate on the official confusion on the neutral rate of interest which has been on a declining trajectory for quite sometime now. Policy-makers have to remind themselves of the lost economic activities and opportunities which their economies once had. Hyper-globalization, de-industrialization, digitalization, artificial intelligence, and robotization have changed the total structure of the economy. With the stagnant and contracted real economic opportunities and the jobless economic growth as well, policy-makers can lower interest rate as much as they like without any fears of the product price inflation (having left the assets inflation aside) and wage rate increase! If policy-makers’ human eyes can’t see the declining absorptive capacity and falling investment opportunities of the real economy; how a model or computer can do so which gives results on what the data being fed into it. May be GIGO (garbage in, garbage out) effect! Once a model/computer starts diagnosing this major human err of feeding the limited data, policy makers will soon be obsolete as well; the way intelligent (driverless) cars are going to do with the taxi/uber drivers!

Unemployment Rate Puzzle

Another contentious issue bothering the policy makers is the declining natural rate of unemployment. Since unemployment rate is at the historically low rate and still neither pushing up the wage rate nor the inflation rate – perhaps this is motivating policy-makers to reach the conclusion that the natural rate is lower than previously thought. It means there is more slack (in the labor market) than thought, that is why wages and prices are not rising as these should otherwise.

Changing economic landscape has also changed the employment structure in the rich nations. Labor shortages and high wage/benefits/pension jobs of the industrial economies have been replaced by joblessness and outsourcing/precariousness/gig employment in the post-industrial phase of the same economies. Three main culprits, for these changes in the employment structure, are considered to be – globalization, de-industrialization, and technological advancement.

Sustained joblessness is not an exception, it has become rather a rule now. That is why, in the US, now U3 (official unemployment rate) measure is less preferred than the relatively inclusive U6 (that also covers part-timers and marginally attached to the workforce, including discouraged ones). However, many other aspects of joblessness might be excluded from the U6 measurement too. For example, long-term jobless people (especially, neither working nor looking for more than an official one-year definition), jobless-turned self-employed (gig entrepreneurs for survival), students in studies because of no suitable job opportunities, forced (involuntary) retirement, joblessness on account of ill-health (mental and physical) caused by un/under-employment at first place and then driving people out of active force. Declining participation rate reveals a lot in itself too. When there is a sustained structural stagnation in the labor demand, the supply of labor will respond in different ways one of which will be ‘no active participation’ in the labor market. (Note: working age population= actively participating labor force [i.e. working or looking for work] + non-active population [out of labor market, however many of them are still interested actually])

Long-term joblessness makes unemployed people hopeless. Since a job is not only a source of livelihood; it is much more than that as it provides identity, dignity, the purpose of and fulfillment in life. One is out of the job market because of hopelessness is not equal to one’s inability and unwillingness. Such joblessness is not natural; it is policy-driven or broadly system-driven. The economic system has made them jobless and caused this hopelessness; and now the same system excludes these people from the unemployment head-count. People’s hopelessness is not an individual problem; because they observe happening the same with their peers, community members and many others in the society – this makes it a social problem. At every point system has failed them. De-industrialization came the first causality on the quantity of jobs, next casualization and precariousness came as the second causality on the quality of jobs. Then came the computer and now coming the intelligent computer (machine learning and artificial intelligence etc.) and robotization. Mass human resource has been on the verge of becoming redundant at the hands of the technology advancement as once livestock (animals) was made by it. Once machines substituted the animals and now intelligent machines are substituting the human beings. People are out of the job market not because they want to be; they are forced out of job market because of the consequences of the anti-labor and/or pro-capital bias of the policy and polity. Capitalists are making labor redundant with their anti-labor technology advancements, and politics and policy-makers are accepting these as if they are subservient to the capitalists instead of the wider society.

When unemployment rate narrows its coverage, excluding most of the unemployed people, due to one definitional constraint or the other. Constrained conceptualization might help make economic modeling easier or let the politicians/policy-makers out of public pressure. But neither the data collected on such indicators (as these exclude more than what these include) represent the realities of the economic structure nor can achieve broader socio-economic results which the society/economy expects from the policy-makers to achieve who use such structural indicators as a base in their policy-formulation.

Wage Rate Puzzle

Now turn to the wage rate puzzle. Why has wage rate become unresponsive to the low unemployment rate and strength in the economy the way it is expected otherwise? Why is expansionary monetary policy unable to push the wages up? This is again perhaps not a problem related with the wage rate or unemployment rate. This is related with the same conceptualization-deficit problem. When an official unemployment rate does not reflect the actual unemployment rate – this is an obvious outcome. In simple words, wage is a price of labor determined by its demand and supply; and in case of excess supply of labor, the wage rate will obviously not rise. And official unemployment figures do not correspond to the actual unemployed labor force. Perhaps that is why news headlines sometimes read that thousands have got jobs but the unemployment rate remains the same or the wage rate remains stagnant; because more people have joined the job market (meaning participation rate has increased). Actually, there is an army of the labor force not considered in the official unemployment rate – e.g. part-timers (waiting for full time jobs), underemployed, gig-employed, gig-entrepreneurs, discouraged, hopeless, etc. – that keeps pressure away from the wage gear. It also highlights a discrepancy between the official and actual figures of the slack in the economy.

Another reason, for wages not rising, lies in the loosened bargaining power of the employees. Forget about unionization etc., these have become now things of the long past in the current economic landscape. This is either because of enough slack or job precariousness or contractual/ sub-contractual jobs (second/third party – when first party contracts out to the second or second to the third), or all. Employees are working at the terms of the employers because they are left with no say or bargaining power. In simple words, they face – this job or no job scenario. If they leave the current job, they will land up with a similar job elsewhere with the similar conditions, if lucky enough to get another job; otherwise joblessness is the only next best alternative. How can one expect such employees to ask for a wage raise? Or can they? There may be many hopeless and voiceless people (most probably unaccounted in the official unemployed labor force), who are waiting to take over. Neither the official natural rate of unemployment nor the low wage rate puzzle can see the hopelessness and voicelessness of those people. Human eyes are needed to see those things. That is why central banks are accepting it that the natural rate of unemployment is lower than what it was thought to be. And intuitively they are accepting that because of the lower natural rate of unemployment, there is no pressure felt on the wage rate to increase at this official low rate of unemployment.

To conclude: either refine the existing macroeconomic indicators to become representative or introduce new ones to reflect the economic realities. Structure of the economy has undergone too many changes for the same old conceptualization to remain relevant. That is why current data don’t reflect the economic structural realities. If existing macroeconomic indicators don’t reflect the structural realities of the economy these are bound to give weird results such as the broken relationship between inflation and unemployment, unemployment rate and wage rate, policy rate stance and real economy, economic buoyancy and price-wage indicators. And when weird theoretical/modeling results would deviate from the factual realities, assumed values would need more and more revisions (to match the realities). The way neutral rate of interest and natural rate of unemployment have been undergoing revisions, for instance.

When the political economy is disconnected with the society, authoritarians win with their divisive tactics and illusive promises of making their countries great again. When the data on the macroeconomic indicators are dis-associated with the economic and social structural realities, valuations will need continuous revisions and readjustments on the policy-makers’ bafflement. Partial equilibrium is perhaps good for an intellectual exercise, it can hardly serve any economic and social purpose in a complex nation! The same way, if economic indicators exclude too much and become unrepresentative of the structure of an economy; such conceptualization-deficit and measurement-deficit will lead to the outcome-deficit. These may be good for the modeling exercises but tend to lose the predictability and applicability in the policy formulation. Economics is applicable if it is based on the facts of the economy, it becomes confusing and baffling when it excludes more than what it includes!

Inflation Targeting Needs Re-examination in the Developed Economies

By Pushpa Kumari

October 5, 2018

Whether macroeconomy is up or down and asset markets hawkish or dovish, surprisingly inflation rate has done very well during the last two to three decades in the developed economies. It raises so many questions. Has price level, a signal of macro-level economic activity, lost its telling power because of monetary policy engineering? How are relative prices so well behaved that these never upset the macro price level? How could relative prices, especially of consumer goods (as the consumer price index is generally used in the inflation targeting), remain so low that inflation rate almost always remains within its target? How the targeted inflation rate has been achieved successfully within the same macroeconomy in which economic growth has been stagnant, domestic manufacturing has lost its ground, asset economy has been boiling, and financial vulnerabilities have been piling up? These questions lead the present commentary to examine the modus operandi of the inflation targeting as an integral part of the management of the macroeconomy in the developed economies.

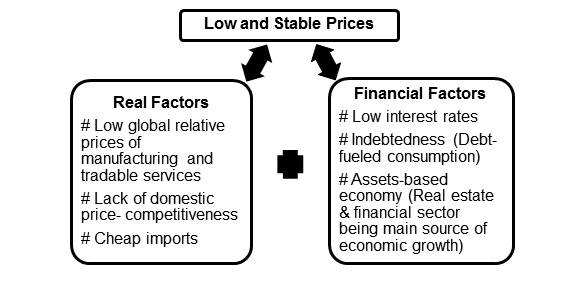

Graph 1: How Price Stability has Co-existed with Weakening Real Economy and Increasing Financial Vulnerabilities in the Western Economies

Graph 1 shows the mechanism how the price stability has been achieved alongside the weakening real economy and vulnerable financial sector. In fact, this graph depicts how poorly the western world has managed their economies in an era of global competition. The shield of low and stable prices has released the pressure from politicians and policy-makers to reform and restructure their economies. Thus, it triggers the discussion that these economies should re-examine the monetary policy regime of inflation targeting and review the entire maneuvering how the inflation targets are achieved.

It has been two-sided dynamics, global and domestic – global factors could enable domestic inflation rate to remain low, and domestic factors kept running the economy and building the financial vulnerabilities at the same time. At the root is the lack of domestic price-competitiveness of manufacturing goods and tradable services vis-a-vis imported ones. In an open economy, when there are readily available imports at cheaper prices who would like to pay for domestic higher priced goods and services. The market would play its role, and obviously imports would be preferred at the cost of domestic products and thus the related industries.

There is a potential for active (rather, proactive) role for the policy intervention here. However, policy-makers can actually play either an active or passive role in this kind of circumstance of global competition. Either they can increase domestic competitiveness with the help of conducive policy-choices and let domestic industries compete with the global imports. Or they can leave economies onto the mercy of market mechanism and let imports flood and fill the markets and consequently kill the domestic industries. Instead of first, a hard route, and making reforms to create competitiveness in their economies, unfortunately, western economies, the so-called warriors of globalization, preferred the second, i.e., an easy route, and let imports take over. Balance of payments reflects the impact of those bad policy-choices in terms of current account deficits.

Not to forget, some developed countries, e.g., Germany and Japan, have successfully met the global competition by augmenting price-competitiveness in their economies; Germany by controlling wages and Japan by profit margins. Also, the East Asian success story of the active role of government in furthering competitiveness in their economies has already been proven.

Perhaps, this is the reason that even too low rate of interest for too long could not help the domestic industry to pick up in the capitalist countries. Instead, it has fuelled the asset markets in these economies. Businesses compare the rates of return across the various alternatives for their investment. When they find speculative assets more lucrative than the highly competitive goods & services’ industries with low global relative prices and low returns, they would make rational choices and prefer assets’ investments over real economy investments. Investing in speculative assets and earning higher returns has been as rational a choice on the part of businesses, as buying lower priced goods and services on the part of consumers.

To complete the jigsaw puzzle, financial deregulation and liberalization have done their part by facilitating the abundant supply of capital. The stable and low inflation rates – alongside deindustrialization-led general deflationary fears (even amidst the asset bubbles), and liberalized financial markets – have allowed the rates of interest to remain low for an overstretched period of time.

Therefore, lack of (manufacturing and tradable services’) competitiveness in global competition made productive investment avenues limited, diverting the investments towards speculative assets on the one hand; financial liberalization facilitated the cheaper finance in abundance to fuel the asset markets on the other. On the other spectrum, anemic economic growth in the western industrial economies made it almost essential to depend on the borrowed funds for the households to maintain their consumption levels. The low interest rate regime has given extra incentives to the households to build-up their debts. The financial sector enjoyed its profit bonanza from the economies based on the debts and asset bubbles, in the process making the financial system susceptible to instabilities.

How far has inflation targeting been responsible in the game of economic stagnation (or even decline) and financial vulnerabilities? It has been responsible to the extend:

- it has released the pressure from the politicians and policy-makers to take actions to increase competitiveness in the domestic economy;

- it has let manufacturing die in the face of global competition, and has led to the decline of alternative productive investment avenues for the businesses;

- it has led to import-dependency and created imbalances (e.g., current account deficits) in the economy; and

- it has allowed financial vulnerabilities built-up by letting the interest rate remain too low for too long, and to create asset bubbles and household indebtedness.

It is how a need to keep the inflation rate within target has been making the western economies almost junk economies with import dependence and financial addiction. Central Banks and policy-makers should stop self-applause now on their targeted-inflation achievements. They should better critically review their myopic-focused monetary policy regime of the inflation-targeting, considering its direct and indirect consequences on the macroeconomy. It is high time to re-examine the inflation targeting in light of struggling economies of the developed world before these turn into ghost economies!

Neither Strongman nor Strongman Politics is New, Only Avatar is Different

Economic-Political Power has Long Dominated the Society

By Pushpa Kumari

September 5, 2018

Where there is a massive discontentment in the general population, there is a way to popular politics. A strongman capitalizes those popular sentiments and takes charge as a warrior of the people. Is it a win of that strongman and his popular politics? Not so, it is in fact a defeat of the past political leaderships that has let built up the social discontent and gave a chance to a so-called strongman. Like it or not, current wave of strongman politics is slowly engulfing all-over the world from the east to west, rich to emerging to poor, from social democratic to democratic to autocratic regimes. Current popular dissent is in a way an expression of social frustration, helplessness and anger which has amassed in the recent history throughout the world. Strong-men all over the world are capitalizing that public resentment with their strongman politics. One can name it rising populism, far right, nationalism, popular rebellion or radicalism.

Social Discontentment as Polity and Policy Diverged from the Social Interests

People, economy and politics are at the core of a nation; their actions and interactions make the landscape of nation-building. Ideally, economy and politics should serve the people. However, this has not been the case in practice. Political economy, especially post-WWII, has diverged greatly from the aspirations of the society. There have been large scale structural changes which have long been upsetting the framework of the society, particularly the economic one. To mention a few, middle class has disappeared, inequality has increased, manufacturing has moved to the global production hubs, large number of populations are excluded from the waves of economic prosperity, decent (unionized) jobs have been replaced by insecure gig employment, private indebtedness is increasing, financial insecurity is joining hands with job and general insecurities, public sector has lost its shine, corporate power has ever been increasing to the extent of bullying, global forces are dominating domestic policy-polity, immigrants are forced on the struggling local economies, wars against terrorism have gone endless, environment is deteriorating, racialism- intolerance- polarization are increasing. So, strongmen have been ruling the (poor!) society for a long time now. Only difference is that this time society is trying with different political persona.

Social discontentment has taken different forms as the evolving divergence between the interests of people and political economy has been widening over time. People have been trying from early on with anti-war and anti-nuke movement of 50s-60s to anti-corporatization, anti-capitalism and environmentalism of 70s to 80s and since then on to anti-globalization, anti-neo-liberalism, anti-neoliberal globalization type protests during recent decades. People have been trying hard to convey the message across, but neither politicians nor policy-makers have given them an ear. In fact, politics and policy have long failed the people. When mainstream establishment works differently than the society mandates to do, anti-establishment social reactions are natural outcome.

Failed Liberalism

In fact, rising of the populism has been in a way failure of the market, open and global liberalism. Local, regional, national, international all levels of governments have long been imposing over people (despite their general refusal) what is the best for them saying that there is no alternative. However, contrariwise people (generally) have been experiencing their conditions actually worsening and their concerns being unheard. This has created a huge discord between the political economy and society. And people have since been searching some alternative who can speak their voice and who can lead them to meet their expectations. The avatar is current strongman and his (strongman) politics.

National disintegration with increasing global integration has been forced on the developed world initially during 50s to 70s, then along with developing countries during 80s and 90s with no end in sight till date. Neither rising tides of economic growth lifted all the boats in the developing countries nor increased prosperity worked well for the majority in the developed countries. People of both the worlds, rich and poor, screamed with demonstrations and movements etc. But no one at right, left and centre of political spectrum heard them. The single-minded political agenda of the global integration to achieve the liberal (market-driven, least-regulated, highly-open) capitalism through post-war institutional architecture has led the evolution of present-day popular revolt in the form of nationalism. Established mainstream is once again being challenged by the counter-forces, but this time around with a different form. This anti-establishment popular voice is nothing but a public cry against the failed liberalism.

Too Much Capitalism

It is not only the politics, capitalism has its own fair share in plying its strongman role for a very long period of time. The well-known is a nexus between the capitalists and politicians; capitalists using their capital power in getting done the laws, policies, taxation, subsidies, regulations (like market, capital, environmental, financial) etc. in their favor. Reckless play of animal spirit and associated boom-bust at the hands of capitalism is the price the entire society pays for years even after the businesses recover from the cycles. There is no law which can protect the society from that recklessness the way limited liability and other laws provide cover to the capitalists. Generally, white-collar crimes are treated with partiality than the other crimes in the society by the judiciary; and even getting justice on favorable terms with the help of expensive (buddy) lawyers and consultants is not difficult. This is not any less than buying the judiciary with the capital power.

Next, about one of the most-selling point, namely corporate social responsibility (CSR), first earning profits with all and any means then donating/charity or window-dressing can be termed as socially responsible behavior in a capitalist system. But how their greed-led tactics harm a society at first place, there is no one to evaluate it in a system with mighty corporates. Isn’t responsible gambling, responsible gaming, responsible smoking, responsible marijuana, responsible drinking type campaigns by the involved addictive-businesses a mockery of the social responsibility?

Yet another (invisible) way of overpowering the society by liberal capitalism is through its most-sung virtues of self-interest and profit-maximization which have made rational individualism almost contradictory to the social values like co-operation, collaboration and collectivism. Business schools have been teaching these (anti-social) virtues and others like these successfully world-wide to the past- present- future generations and getting huge profit-rewards too. Social values make human being a social animal and unwarranted individualism makes human being a beast filled with ego, selfishness and self-righteousness. That is how social cohesion, co-existence and mutualism have now become ornamental terms, whereas in reality me-alone, why me, not in my backyard are the most practiced phrases.

This is the unchecked mighty power of the corporations that they are at loose to shape the social attitudes, behavior and preferences with their persuasive advertising. It is the brand that determines the value rather than the virtues of an individual. Classification and patternization have hardly left any room for natural originality, simplicity and diversity. For example, particular colors are classified for particular gender/class and certain toys define the particular children. Its not the right versus wrong that prevails, it is the manipulative influencers being always right and the other is always a passive stakeholder. These are the corporations with their persuasion/advertising power that these are directing individual tastes, choices and status. Apparently, these signs may be termed as the strong-ness of the market-based capitalist system but actually these bound and constraint the human freedom, originality and creativity on the one hand and inculcate division, intolerance and anxiety in the society on the other.

Individual liberty is notional in such a so-called ‘greedy or profit-hungry’ liberal capitalism. Political economy is doing what capitalism is dictating. Their nexus has overpowered the society; and both are playing with the people for their own interests with their ever-increasing influence and power.

Question Marks on the Strongman (Politics)

The current strongman avatar is generating apprehension in the intelligentsia circles. As conventional wisdom goes, a strong leader makes a nation strong by making its society and economy strong. Even world becomes a peaceful place with strong leaders. So, what is the problem with the present strongman politics? The problem is that neither strongman politics appears to have the strong values nor strongman a strong character. Both strongman and his politics are fine if (big IF) there are strong values at the base. Then this strength is constructive and a gift in deed. Otherwise both strongman and strongman politics are destabilizing, destructive and dangerous. These (pseudo) strong men are manipulating, power-hungry, intolerant, divisive, unjust and selfish. And the politics with such arrogant leaders would lead/add-on to polarization, division, power-imbalance, inequality and injustice in general. Strong character has strong values of humanity, integrity, equality, justice, tolerance and fraternity. This is a strong character world celebrates Abraham Lincoln, Mahatma Gandhi, Mother Teresa and Nelson Mandela like personalities forever.

A nation can have a strong economy, strong military and strong politics – but without a strong character it can not sustain all these strengths in the long run. Such nations can not have real freedom, equality and justice in their rules, systems and governance. The powerful dominate and rule. Whatever values they boast are generally notional, face-saving and pretence. Whether it has democracy or autocracy – the intention and the outcome may not change, what changes is the form or degree. Even globally, strong nations (superpowers) without character lead to colonization, exploitation and dominance only, as history is full of such examples. Such superpowers are remembered for their tyranny, plunder and carnage. For such powers, it doesn’t matter who those oppressed are whether natives, colonial people, foreigners or even their own people. Their target is to maintain the power, come what may.

Solutions: Power Dominance to Go; Society First; and Strong Character to Lead

Where is the equality when there is power imbalance (might is right!)? Where is the liberty when choices are framed and decisions are influenced (powerful persuasion!)? Where is the justice when laws are biased (rule of power!)? Where is the democracy when people have no say (power politics!)? Where is the human dignity when livelihood and future are at stake (power of political-corporate nexus!)? That is why top-layer institutions of state, administration, religion, justice, politics, policy have long failed the people; and next-layer institutions of education, sports, aid/development etc. have failed them too. There are plenty of examples – plight of Natives, racial bias, political economy ignoring people and environment, corporate bullying, clergy abuse, gun-violence, admission-bias in universities, abuse scandals at sports organizations, Flint water crisis, differential Puerto Rico storm recovery response, and exploitations by humanitarian aid agencies – all these showcase the governance in the richest and strongest nation of the world. This is the same superpower (strongest nation) that has for long been governing the world at its whims and fancies, directly or indirectly, through the multilateral arrangements. In fact, a hard fact is that this is a story not only of America, whole world is going through a challenging time. 99% vs 1% and #MeToo Movement etc. narrate the story of global society, spoken or unspoken. What else can be expected when institutions are structured by the powerful and for the benefits of the powerful!

Power is balanced with the responsibility. If responsibility is not realized, it would lead to misuse of power. Power misuse results in corruption, suppression and exploitation. World needs visionary strong characters to lead the nations who can think beyond the interests of the few (powerful) and salvage the disgruntled society from the powerful nexus of corporate and politics. Who can force the political economy and corporations to protect the social interests. Who can save the earth from further deterioration. Who can lay humanity, human values and social values on the top than anything else. Who can preserve the interests of future generations intact. Unfortunately, there are many strongmen rising up all over the world; however, world needs strong characters to show the right path!

Globalization and Structural Shifts in the Developed World

From Industrialized to De-industrialization to Post-industrial Economies

By Pushpa Kumari

August 5, 2018

Globalization has affected not only the foreign trade but also the structure of the developed world. It has generated several shifts in the organization, functioning and outcomes in these economies. These structural shifts have since long been penetrating through, with varying degrees, their economy, society and politics via several domestic and foreign channels. It is significant to examine these shifts given their structural nature and long-term implications for national as well as international standing. It is especially intriguing to connect a stage of industrial activity with the economy’s global-interface and then examine the associated socio-economic-polity outcomes. This is particularly important in light of the growing populist social and political discourse in these nations.

In a globalized world, post-industrial economies have services as dominant sector not only because of increasing relative share of services in their output but also because industrial sector has generally moved to the southern global-manufacturing nations. Therefore, de-industrialization and post-industrialization phases are not a result of the natural economic progression, these are shaped by the conscious actions of the national and international players. Moreover, decline in the relative share of industrial sector to the total economy (as economic development reaches a maturity level) was what economic theory suggested, de-industrialization was not.

The structural shifts, under the industrial, de-industrialization and post-industrial phases of an open developed economy, relate to the evolution of several inter-related factors from one phase to another – like, manufacturing, employment, job-quality, retail structure, influence on consumer behavior, finance, consumption/saving, corporate power, foreign trade/capital, foreign influence, domestic policy-control, and others. However, evolving factors grouped under each industrial phase will be a mere simplification of a dynamic and progressing (continuing or even overlapping beyond one phase) economic construct to another level with regards to every activity involved in it. For instance, abundant job opportunities in industrialized economy turned into mass layoffs, job casualization and contractization in de-industrialization phase, and then to joblessness and gig employment in the post-industrial phase. So, it is the nature and form that largely characterize the next level will be mentioned in that particular industrial phase. Given below is a representative list of structural shifts depending on the global-penetration in the domestic economies of western capitalist economies:

Industrialized Economies

o Vibrant industrial sector

o Domestic manufacturing, Integrated factory floor

o Specialization-based foreign trade in goods

o Foreign capital outflows (aid flow)

o Democratic retail sector, Small retailers (Mom-&-Pop stores)

o Local stores being influencers/trend-setters (what to be produced)

o Relationship retailing

o Thriving local economies

o More jobs than workers

o Income-based consumption, high domestic savings

o Banking into basic intermediary functions

o Political control on domestic policy-making

De-industrialization

o Globalising economies

o Declining manufacturing

o Multinational corporations

o Foreign direct investments

o Foreign trade in goods and tasks (off-shore value-chains)

o Corporate Power

o Big retailers (Walmart-type)

o Neutral retailing

o Mass production

o Mass marketing

o Mass consumption, consumerism

o Mass lay-offs, job-uncertainty

o Domestic job casualization and contractization

o Financial liberalization

o Debt-financed consumption, declining savings

o Asset-bubbles

o Loosening control on domestic policy-making

Post-industrial Economies

o High global integration

o Global manufacturing

o (Near) foreign-manufacturing-dependency for durable/semi-durable goods

o Foreign capital reversal (inflows more than outflows as current account deficits),

o Nations’ competition (nations competing with each other) vying corporations

o Rising nationalist (to acquire/innovate/lead) agendas on advanced technologies (techno-nationalism), techno-manufacturing, cyber, space type industries to own national control on the future

o Foreign interference through politics (like, donations, election influence), policy, investment, cyber etc. routes

o Bullying corporations

o Online retailers (Amazon)

o Digital retailing

o Influencer Marketing

o Short products life cycles

o Shifting online third-party selling to direct sellers (for example, Amazon has been approaching for quite some time now the small producers in China and facilitating them to sell directly on its platform)

o Developing online direct buying-selling is destructing most mid-level trading chains and related businesses

o Gig economy, precarious work, joblessness

o Anemic growth

o Post-industrial (struggling) economy

o Financialization of economies

o High (especially, household) debt levels

o Asset-economies

o Few domestic policy-options

There may be conflicting views over what is the cause/effect depending on who favours what; trade-favoring school might have different opinion than the anti-globalization school. These changes are for better or worse depends who is asked this question. A job-loser might have different opinion than a job-earner, and similarly a WTO official might have different evaluation than a local official of a (post-industrial) ghost town. However, there is definitely a social anxiety at large about the situation because it is the society that faces the harsh ground realities. People are uncertain about if they will have any work/earning, if they will be able to pay bills, if they will be able to see a doctor and buy medicines when they are ill, or what will happen when they have no work or when they are old. Perhaps current far-right and nationalist political rise in the developed countries is a result of those social insecurities and vulnerabilities.

Cheaper goods and services in exchange of income, employment and local/ domestic economies is obviously a questionable trade-off. The above discussion raises the instinctive questions: if it is too liberal a globalization; or if it is free market competing with aggressive mercantilism; or if fundamentals of capitalist model are flawed; or if it is too much reliance on the self-correction of the market system; or if it is developed countries’ complacence and underestimation of competitors’ capacity; or if it is the mismanagement and missed-realignment of the western economies in the evolving face of global competition. Whatever is the actual cause(s), the actual picture is worrisome and expressed simply as what is next?

Superpower War of the 21st Century – Declining America and Fading Capitalism Versus Rising China and Shining Communism!

Will US Trade War Conclude the Third World (Cold) War Started in the 20th Century?

By Pushpa Kumari

July 5, 2018

Historically, a transition from one superpower to another has involved a war. If history repeats itself, should the recent US trade war be assumed as a last phase of the superpower transition from the US to China? Last transition took place during the WWI from then superpower the UK to the USA. During war the US became the biggest wartime trade and finance supplier for the UK, and it was in 1916 when US output outpaced that of the entire British empire. From then on there was no looking back for the US for several decades. However, now the 20th century superpower has been on its descending journey to become a history like European nations, the UK, and Russia (competed with the US till 1991) did in the past. This is yet a first quarter of the 21st century and the wheel looks turning away from not only the US as a superpower, but also from the centuries’ old capitalism as a dominant system. All signs are signalling that China is ascending as a superpower and communism is winning over capitalism. China’s rising power at old economic-political-military fronts and new technological-cyber-space fronts is undisputable. State intervention vs Laissez faire is weighing towards state’s positive role in the direction, governance and delivery of the economic, social, political, technological and environmental outcomes.

The third world war, emerged after the WWII, was in the form of cold war and long fought between two 20th century superpowers, the US and Russia, along with their respective western capitalist and eastern communist allies on both sides. With the fall of Berlin Wall in 1989 and collapse of Soviet Union into separate nations in 1991, it was thought to be a fall of communism and an end of cold war between two competing superpowers. However, political form of cold war with Russia seemed to be over then, but it re-emerged that time around in the form of economic war heralded by mercantilist China. After several twists and turns, now it seems to have reached an inflection point with declining US (representing the capitalism) and rising China (representing the communism). Main feature of the present form the third world war has been that it is non-conventional – as it is high-tech, without borders, without human causality, and without much fanfare. Rising Russian aggression in Europe also indicates re-strengthening communist Russia. Communist North Korea, with its renewed nuclear capabilities, is also challenging not only Korean peninsula but also the US. Cambridge Analytica, Wikileaks, cyber attacks, Panama Papers, and foreign political influence etc. have already exposed how external forces can influence every nook and corner (including democratic structures) of the capitalist world, whether this is North America, Europe, Asia, Africa, Australia, New Zealand or any other place on the earth. Whether or not this involves hands of other (communist) state(s) or non-state actors, it has exposed the truth whatsoever economic prosperity and national security capitalist nation states have built in and around them are not foolproof and immune to the attacks from outside.

Promotors of capitalism may term the shining communism as a win of authoritarian and manipulating regimes over democratic and rule-based system. However, a rule-based system is not necessarily just, if the founding rules themselves are biased. In reality, democracy and rules have hardly been just, balanced and equal for all. These have generally been power driven, capital-biased, imbalanced, and non-harmonious. Such upshots have evolved from the organic nature of the capitalism itself and have long inflicted the human civilization with its historical progression. Mercantilism, colonialism, market distortions and manipulations, neo-liberalism, globalization, neo-imperialism etc. all building organisms of capitalism over time have well served the interests of capitalists throughout its evolution with the help of state machinery (legislature, executive, judiciary, and even press). No wonder, why present-era most capitalist nations are experiencing some of the similar outcomes, like: structural imbalances (saving-investment and current account), excessive corporate power, asset economies, wealth concentration, economic inequality, social exclusion, consumerism, environment degradation, ecological destruction, political polarization, and individual extremism. In brief, capitalism has failed the economies, peoples, societies, and ecology. As of now, rising China, with its communist system, seem to use centuries old mercantilist, dominance and invasion tactics to become a superpower; time will judge the rising superpower’s character and system’s legitimacy through local, national, regional, global, and spacial outcomes.

‘America first’ and ‘make America great again’ are, in a way, a confession that it is no more the same first power as it was in its yesteryears. Its acceptance in a recent White House report (“How China’s Economic Aggression Threatens the Technologies and Intellectual Property of the United States and the World”) that the US and the world could not fight the economic, cyber and technological aggression by China. The recent trade war by the US, in fact, indicates its desperate move to regain the post-war economic prowess, but unfortunately this time without its partners. Unsuccessful wars against terrorism in Afghanistan, Iraq and Syria demonstrate its (along with its allies) strategic downfall. Clearly, America’s powers at economic, political, strategic, technological, diplomatic fronts have been declining.

Since 1977 current account of the US has continuously been in deficit with only three years’ exceptions (1980, 1981, 1991), meaning thereby the US has become a permanent debtor. But another important shift took place in 2013 when the US GDP at Purchasing Power Parity (PPP) was overtaken by China. With uncontrolled trade deficits, especially with China since 1985, a promoter of free trade has now turned against it. Actually, the US has since beginning blamed some one or the other for its deficits – in 1980s first it was Japan then south Korea, since 1990s upto financial crisis came China, and post-crisis it is Germany. Of late, it has started blaming almost every other nation for being unfair with it in trade. Pulling out of Trans-Pacific Partnership (TPP) and threat to pull from North American Free Trade Agreement (NAFTA) also indicate its anti-trade tone. With its steel and aluminum tariffs, the US has launched trade war with its trading partners, be neighbors (Canada and Mexico), or EU members, or China and other Asian nations. Current desperate trade moves of the US expose its challenged superpower position. Instead of setting right own house by tackling its structural problems, its blaming and name-calling others may appease its own old superpower ego; but it will not gain its lost trust and power.

During the old cold war years, the US used its aid and trade policies as an instrument of foreign policy to keep nations together in its camp or away from communist camp. A gamut of formal institutional structure was established under the US leadership, for example United Nations, Bretton Woods twin institutions, GATT (later WTO), and NATO. Entire post war multilateral organism has been in fact to showcase that capitalism is a rule-based and fair system. And also, through this multilateral organisational structure, the US aimed at fulfilling its own agenda to gain and maintain its superpower position. After the fall of Berlin Wall and dissolution of the USSR, the US became an undisputed global superpower in the unipolar world, and capitalism turned out to be the only efficient economic system with no competent alternative.

Circumstances have changed; with the decay of power, now the same multilateral establishment and rules have become a liability for the US. The US, who was instrumental in this post-war establishment, has become now critical of it. Because its own rules now seem to be binding it. Its withdrawal from the UNESCO, Paris Climate Accord, and UN Human Rights Council does reflect its anti-establishment rhetoric. No surprise, if WTO, NATO, another UN agency, or any other international organization is the next.

Strong allies help any superpower maintain its position globally as it happened with the US in WWI, WWII, and even during cold war. But things have turned different now: US has created rift with almost all time-tested old friends whereas China has strong allies on its side like Russia and North Korea. No doubt, China has territorial issues with its neighbors (Japan, South Korea, India, Taiwan, Philippines, Mongolia, Vietnam and some others) but two things will keep balance in favor of China; one, individual nation may not have that military capability to handle a war with the nuclear China, and second, many nations have trade, investment and value-chain linkages with China too, so those nations would not like to risk their economies.

China has become a world factory forcing factories shut elsewhere in the world, especially the rich world. It has turned the industrial nations almost deindustrialized. Its state-run, state-sponsored and state-supported industrial sector’s success is well documented. In 2015, China’s share (produced or assembled) in total global supply of various products were: more than 90% mobile phones, more than 80% computers, 80% air conditioners, 60% color TV sets, more than 50% refrigerators, 50% steel, 41% ships, 28% automobiles, and 24% power (as per the European Chamber of Commerce in China). Military-wise, China is undoubtedly a top-tier military power like the US, Russia, France and the UK; hence, capable of fighting a nuclear, cyber and conventional war. It is one of the only three powers on earth, besides Russia and US, capable of operating space-based military presence, offence and defence. China has emerged as the third largest exporter of weapons (after the US and Russia). China’s expanding military aspirations are not hidden – world’s second (after the US) largest military budgets and increasing at a high rate (8.1% in 2018 from last year’s 7%) might not even reveal the real figures which might actually be much higher than the official figures. Funds given away elsewhere in fact might be a part of military outlay, like on the subsidies (to material production used by military), nuclear, strategy, paramilitary, corporate technologies and application (with dual use – civilian and military) e.g., robotics, artificial intelligence, drone, semiconductor chip, virtual reality etc. Furthermore, not revealing the actual figures is in its strategic and economic interests, after all China would not want to jeopardise its economic interests (by agonizing the west or its own neighbors) which are in fact underlying condition for the another, i.e. building its military might. Silk Road, South Sea initiatives and ‘Made in China 2025’ have generated enough anxiety globally already.

The third world war between capitalism and communism is at present on the verge of turning the wheel away from capitalism. So, neither capitalism (as the only system) nor the post-war II champion of capitalism, the US, could prevail forever. One question is still left: will there be any hot war to conclude this transition between the rising and declining forces, using the modern 21st century hi-tech warfare. Time will answer this question, but in case the answer is ‘yes’, it is the humanity who will suffer the most (who knows, may be earth, space or universe too this time!); unfortunately, superpower or any system (whether capitalism or communism) have no human face. Declining superpower, falling old alliances, and weakening multilateralism are turning the post WWII “new world order” old. What next world order will look like, perhaps no one knows; but a reasonable wishlist would include prosperity, security, human rights, good governance, and a safe universe FOR ALL!

Second-hand Clothes Trade Conflict Shows That Emperor Has No Clothes

By Pushpa Kumari

June 5, 2018

Trade conflicts are normal because nations may have their own national interests which at times are conflicting. But the trade conflict under discussion here is fairly abnormal. This is a trade conflict not between two normal trading partners, but America is at trade conflict with Rwanda. One nation having GDP 2224 times bigger (the US $19 trillion) than the other (Rwanda $8 billion). More important than the size of economy is the item of conflict – second hand clothes. These are dumped hand-me-down clothes sold for-profit by America to the poor African nation Rwanda. Basically, this conflict between two economically asymmetrical nations and that too over a trivial item signifies the bigger political economy of dominance and dependence.

Neither America is the only exporter of these worn clothes nor Rwanda is the only importer. Worn clothing is about $4 billion export industry globally. In 2016, the US had about 15% share ($639 million) of it. Some other countries were UK (11%), Germany (10%), Rep. of Korea (6%), China (5%), followed by Netherlands, Poland, Italy, Belgium and Canada (each having share of 3 to 4%). And on the import side, Pakistan had the highest share of it (6%), followed by India (5%), Malaysia (4%), Russia and Kenya (3% each) among many others. Though, exports and imports taken together to account the trade deficit in this worn clothing category: the largest trade deficits were recorded by Sub-Saharan Africa ($908.4 million), Latin America and the Caribbean ($369.1 million) and Southern Asia ($262.2 million) during 2016. Coming back to Rwanda, it is an eastern African nation with mere 0.47% share ($17.7 million) in the total used clothing imports in 2016, and also a part of Sub-Saharan Africa that holds the highest trade deficit in this product category. (Note: all the data used in this paragraph is taken from UN Comtrade and UN International Trade Statistics Yearbook 2016.)

The root cause of this conflict lies in a Joint Communiqué, the East African Community (EAC) issued in March 2016, expressing their intent to progressively phase out importation of used clothing as a means to support the region’s textile and apparel industry. In reaction to it, a US trade association – Secondary Materials and Recycled Textiles Association (SMART) – made a request for an out-of-cycle review (OCR) of the eligibility of the EAC states for the African Growth and Opportunity Act (AGOA) privileges citing loss of American jobs, and trade barriers as a breach of the AGOA provisions. The AGOA is a part of Trade and Development Act of 2000, enacted during the Clinton presidency. It extends duty-free and quota-free access to over 6,400 products from the Sub-Saharan Africa (SSA) into the US market. The purpose of AGOA is to foster economic and political development in SSA by expanding access to U.S. trade and investment markets. However, after the AGOA review request, other EAC members – Kenya, Uganda and Tanzania – backed off at later stages, but Rwanda remained stuck to its original intention. That is why, it has become a contentious issue between the US and Rwanda.

How this conflict demonstrates that the emperor (US) has no clothes:

- Unhumanitarian and Unethical: actually, historically, East Africa had thriving clothing industrial sector during 1960s and until early 1980s. Cheap imports of second-hand clothes under the trade liberalization (as a part of economic reforms after the 1980s debt problems) have killed this industry. Not letting a chance to a poor nation to revitalize its lost industry, local economy, income and employment would be an utter unhumanitarian and unethical act on the part of a so-called champion of aid and development activities under the type of USAID and AGOA institutions.

- Double standard: it becomes a matter of pride if the richest nation on the earth says America first, American manufacturing jobs, America Great Again. But what if one of the poorest nation says it wants basic level of development and dignity…it becomes a subject to sort of sanctions.

- Invisible Conditionality: if Rwanda wants to be eligible for AGOA privilege, it has to meet the conditions of the US; even if Rwanda’s actions actually are as per the intention of the AGOA, i.e., the long-term development of a poor country. Here, the conditionality is not related with the establishment of the democratic institutions etc. in that country. Instead, this is about the market access to the US exports. If Rwanda wants AGOA privilege, it has to give its market access for American products, no matter if it is at the cost of Rwanda’s economic and social development. Similar conditionality was being tried on South Africa in 2015 when it attempted to ban US chicken imports because it was killing its poultry industry; as this time around on the East African Community nations for the US second-hand clothing imports. But when the nations reluctantly give in to the US threats they immediately become eligible to the AGOA benefits. In trade diplomacy AGOA may be a negotiation tool for trade deals, or in alternative to the mainstream philosophy AGOA may be a strategy to realise hegemony; but in simple economics terms, it will be AGOA conditionality (just like aid conditionality by IMF and World Bank, human rights conditionality for OECD humanitarian Aid).

- Imbalance of power: this is an imbalance of power that the US is trying to exploit because Rwanda is a poor and weak nation. Here Rwanda wants to develop its landlocked resource-lacking economy through low-skilled labor-intensive clothing industry. But the powerful partner says you will be punished if you do not accept my second-hand exports of the same products which you intend to develop. Moreover, this is nothing new in Rwanda wanting protection to its nascent industry from the imports as this is what the western and rich world had done in early phases of its development too. As famous economist Nicholas Kaldor noted “… policies of fostering domestic industries by judiciously chosen methods of import substitution – the replacement of imports of manufactures by domestic production – which were so successfully pursued by the countries of Western Europe, North America, Japan and other “developed” countries in the late nineteenth century and the present century….”

- Economics vs. Power Economics: trade theory put forward by Ricardo does not apply where power economics rules are applied. Ricardian theory of comparative advantage might have rightly predicted US importing textile and clothes because of its comparative advantage in producing high-tech products. But he might not have predicted US exports of second-hand clothes to the poor nations against their wish because this is what only power economics can predict. How poor African nations can challenge the hegemony of a superpower by denying its imports. The superpower certainly would not allow Rwanda like country to set such an example for other countries.

- Might is Right: who is right, obviously the mighty one. How this is true in the case of second-hand clothing (mighty) exporter. a) It has less to do with American industry and manufacturing jobs, because first, these clothes are anyway manufactured already and used/worn by the Americans, second, majority of these clothes are imported from the third country like, China, Malaysia, Philippines, Pakistan etc.; b) Americans would not wear these clothes; they have anyway discarded these clothes; c) these clothes are mostly collected from the drop offs at charities or donation bins in the parking lots. If these clothes are not exported, these will end up in the landfills as other discarded curbside stuff, like furniture, appliances, books, mattresses etc.; and d) charities which work for good cause earn profits by exporting these to the countries including third world with widespread poverty. To note, many of these charities might be involved in the noble work of these countries’ development. How a nation can be wrong and punished for wanting its dignity back by not wearing the thrown away second-hand clothes — because might is right!

This uncovers the truth about the development diplomacy of the rich and powerful world. They might sell the fancy institutions like USAID (American), DFID (British) ODA (OECD), CIDA (Canadian), and recently National Development and Cooperation Agency (Chinese). But their first priority has been their business interest instead of the development of the poor countries. Maybe this interest clash is one of the major factors that despite ‘so advertised’ decades’ efforts by myriads of (multilateral, regional, and national level) development organisations, development of numerous nations is yet a distant dream. Words might cover the truth but actions and results uncover the truth of development efforts. Superpowers may change – for instance, first Europeans and the UK, later the USA and now China too – with their own contemporary mighty ways and means; but legacy remains the same. Capitalism or communism are the same extensions of the old mercantilism, colonialism and imperialism. Nothing changes because this is a game of power.

Pay Gap between CEOs and Workers in Canadian Industry, 2015

2015 survey examines the pay gap between the CEOs and workers in the Canadian industry as a whole and also in its different sectors

—————————————————————————————————————————–

Pay Gap between CEOs and Workers in Canadian Industry, 2014

2014 survey explores the pay gap between the CEOs and workers in the Canadian industry as a whole and also in its different sectors

——————————————————————————————————————-

Pay Gap between CEOs and Workers in Canadian Industry, 2013

Pay Gap between CEOs and Workers in Canadian Industry, 2013

2013 survey finds the pay gap between the CEOs and workers in the Canadian industry as a whole and also in its different sectors

——————————————————————————————————————-

Pay Gap between CEOs and Workers in Canadian Industry, 2012

Pay Gap between CEOs and Workers in Canadian Industry, 2012

2012 survey covers how big pay gap between the CEOs and all other workers is in the Canadian industry as a whole and also in its different sectors.

——————————————————————————————————————-

Canada’s Household Debt Mess – What has Caused It?

Study finds that several factors at macro and financial sector level are responsible for the debt mess. Debtors can be blamed for borrowing too much, however financial organizations are also responsible for lending that much, and above all the government and regulatory authorities, too, accountable for letting an excessive borrowing-lending happen in the economy.

——————————————————————————————————————-

Pay Gap between CEOs and Workers in Canadian Industry, 2011

This year’s survey covers how big pay gap between the CEOs and all other workers is in the Canadian industry as a whole and also in its different sectors.

——————————————————————————————————————-

Too Big CEO Compensation = Too Little Social Responsibility

Study finds that it is not only the big amount of the CEO pays, but also the process and the impact, all reflect the socially irresponsible behavior on the part of CEOs.

—————————————————————————————————————–

Pay Gap between CEOs and Workers in Canadian Industry, 2010

Pay Gap between CEOs and Workers in Canadian Industry, 2010

This survey covers how big pay gap between the CEOs and all other workers is in the Canadian industry as a whole and also in its different sectors.

Canada’s Household Debt Mess – What has Caused It?

This study finds that several factors at macro and financial sector level are responsible for the households’ debt mess. Debtors can be blamed for borrowing too much, however financial organizations are also responsible for lending that much, and above all the government and regulatory authorities, too, accountable for letting an excessive borrowing-lending happen in the economy.

This study finds that several factors at macro and financial sector level are responsible for the households’ debt mess. Debtors can be blamed for borrowing too much, however financial organizations are also responsible for lending that much, and above all the government and regulatory authorities, too, accountable for letting an excessive borrowing-lending happen in the economy.

2014 survey explores the pay gap between the CEOs and workers in the Canadian industry as a whole and also in its different sectors

2014 survey explores the pay gap between the CEOs and workers in the Canadian industry as a whole and also in its different sectors